Higher Beer Taxes Are Not the Answer

In uncertain economic times, the first things people start to cut back on are dinners, nights out or simply picking up a few drinks for a weekend barbeque. This is bad news for the millions of jobs in the brewing, agriculture, retail and hospitality industries.

Inflation and supply chain difficulties are just the latest in a long line of threats for many of the small businesses that make up the beer economy.

Now some lawmakers want to increase excise taxes on alcohol, which will raise prices for consumers. That’s the last thing our economy needs. Stand with us as we tell lawmakers that these businesses and the Americans they employ need help, not higher taxes.

Click on the interactive map to see the impact of the beer economy in your state.

CONSUMERS ALREADY PAY TOO MUCH IN BEER TAXES

The federal government, all states, and some local jurisdictions impose excise taxes on alcohol. In some instances, a glass of beer is made up of 40% in taxes. Wherever you buy your beer, these taxes are passed on to you. If lawmakers raise beer taxes do you trust the government to spend that money wisely?

- Say No to Higher Taxes

- Say Yes to Saving Jobs and Local Business

- Lend Your Voice, Make an Impact

TAKE ACTION NOW

Contact Your State and Local Lawmakers

Higher beer taxes will hurt local businesses that have already faced challenges, from economic downturns, to supply chain disruptions over the past several years. Lawmakers must enact policies that make consumers stronger and promote job growth in the industries that make up the beer economy, from agriculture to hospitality and retail.

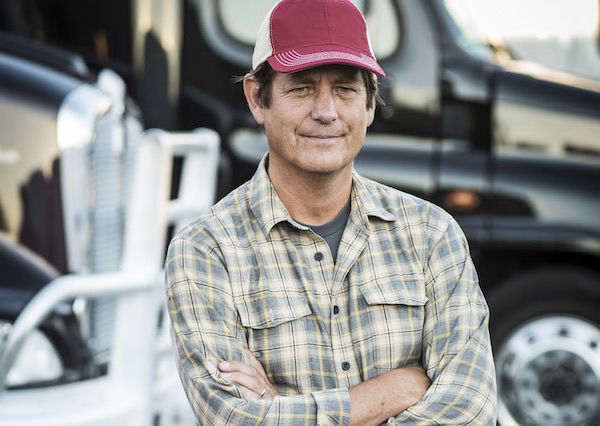

FACES OF THE COALITION

The efforts of the Save the Beer Economy coalition protect millions of employees in the agriculture, retail and hospitality sectors from unnecessary tax and regulatory burdens that threaten their livelihoods. Read powerful stories from workers and small businesses whose jobs depend on the production and sale of beer.

READ MORE

JOIN THE MOVEMENT

Sign up to receive updates on beer tax increases in your community

The success of the beer economy affects small business owners, hourly workers and consumers alike. Register here to be the first to know when proposed beer tax increases come to your community and learn how you can help.

Join the movement